- Home

- About

- Globally Speaking

- Videos

- Podcast

- Geopolitics

- Industry

- SIGN UP

Tangible actions on climate change and green development help reenergise the entire climate finance industry.

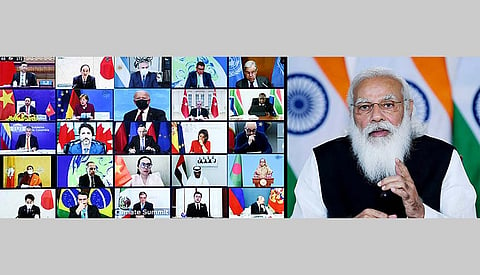

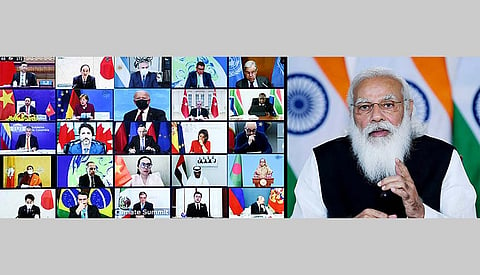

When Indian Prime Minister Narendra Modi and his UK counterpart Boris Johnson signed off on a new shared roadmap during their virtual meeting on the sidelines of the G7 summit a couple of weeks back, it not only set off in motion vital measures to help limit global warming, but also tangible action to support communities most vulnerable to the impact of climate change – thereby reenergizing the entire climate finance industry.

Those pledges came close on the heels of the United States and India launching a new high-level, US-India Climate and Clean Energy Agenda 2030 Partnership to create stronger bilateral cooperation to meet the goals of the Paris Agreement. Led by US President Joe Biden and PM Modi, the partnership represents one of the core platforms of US-India collaboration and focuses on driving urgent progress in this critical decade for climate action.

Both the United States and India have set ambitious 2030 targets for climate action and clean energy. In its new nationally determined contribution, the United States has set an economy-wide target of reducing its net greenhouse gas emissions by 50–52 percent below 2005 levels in 2030. As part of its climate mitigation efforts, India has set a target of installing 450 GW of renewable energy by 2030. Through the partnership, the United States and India have committed to working together in achieving their ambitious climate and clean energy targets and to strengthening bilateral collaboration across climate and clean energy.

The US India climate finance partnership will mobilize green finance and speed clean energy deployment; demonstrate and scale innovative clean technologies needed to decarbonize sectors including industry, transportation, power, and buildings; and build capacity to measure, manage, and adapt to the risks of climate-related impacts.

The partnership will also aim to mobilize green finance and speed clean energy deployment; demonstrate and scale innovative clean technologies needed to decarbonize sectors including industry, transportation, power, and buildings; and build capacity to measure, manage, and adapt to the risks of climate-related impacts.

Proceeding along two main tracks – the Strategic Clean Energy Partnership and the Climate Action and Finance Mobilization Dialogue – the partnership thus offers a plethora of opportunities for climate finance, with both countries keen to demonstrate how the world can align swift climate action with inclusive and resilient economic development.

“Strong financial support and timely policy interventions from the Government of India have played a crucial role in accelerating the growth of the country’s renewable energy sector. But given current rates of penetration and the overall health of the sector combined with slowdown created by the COVID-19 pandemic, the government will have to find new and alternative ways to finance the transition and incentivize private sector participation to scale up investments for a sustainable and transformational impact,” said Mahua Acharya, Jolly Sinha, Shreyans Jain and Rajashree Padmanabhi.

“International finance is also likely to come with ‘green strings’ attached. Therefore, identifying and analyzing key sources of finance, the instruments used for mobilizing and disbursing funds, and their ultimate beneficiaries become critical for diagnosis, planning and monitoring green investments in the country,” the economists wrote in a policy paper for Climate Policy Initiative.

The partnership between UK and India also promises to unleash opportunities for sustained action and investments in the sector.

“The UK and India share a longstanding partnership and I am greatly encouraged by the steps we have taken to bolster our joint efforts on tackling climate change,” said COP26 President-Designate Alok Sharma. “If the world is to become net zero by the middle of the century and keep 1.5 degrees in reach, everyone must work together to make real change for a cleaner, greener planet. I am proud of the close collaboration on this crucial issue which our two countries have forged, especially during this very difficult time for India as it battles with Covid,” he said.

The roadmap sets out an ambitious agenda for UK-India collaboration on fighting climate change, including a new partnership on clean energy transition, which will drive progress on development of renewables like offshore wind, improved energy efficiency and storage, and advances in electric mobility.

If the past few years are any indication, the majority of bilateral funds (56%) went into the sustainable transportation sector in India, as loans for infrastructure development of metro rail projects. A major part of the FDI was also equally split between solar and wind energy projects due to the presence of advanced markets.

Both countries have also committed to collaborating on green hydrogen, and jointly launch a new global Green Grids Initiative at COP26 for countries to work together on interconnected grids for renewable energy, to help deliver India’s vision of One Sun One World One Grid.

The most critical aspect of the partnership, however, is the willingness of both India and the UK to explore the possibility of enhanced partnerships with major private finance leaders, including with the Climate Finance Leadership Initiative, to mobilise both public and private finance for green development. India and the UK have also welcomed climate action by businesses and encouraged other companies to do the same. Businesses who have recently made Net Zero commitments through the UN’s ‘Race to Zero’ campaign include the Neev Fund, Engineering Export Promotion Council of India, Gayam Motor Works, M/s Claro Energy Ltd, Commonwealth Inclusive Growth Services Ltd, Evolve India, Suryadesh, Rolls Royce, Diageo and Grundfos Pumps India Pvt. Ltd.

The mobilization for major climate finance initiatives comes at a time when Foreign Direct Investment in the renewable energy sector has crossed the $1 billion mark.

If the past few years are any indication, the majority of bilateral funds (56%) went into the sustainable transportation sector in India, as loans for infrastructure development of metro rail projects. Delhi and Mumbai metro rail projects received the lion’s share of these funds (45% and 25% respectively). On the other hand, multilateral funds were targeted at the development of solar parks and rooftop projects (40%) in the country.

A major part of the FDI was also equally split between solar and wind energy projects due to the presence of advanced markets.